2012 Trading and Industry Report

Posted: 2012-12-21 Filed under: eveonline, industry, market, ships | Tags: archon, charon, chimera, deadspace, faction, ishtar, maelstrom, nidhoggur, obelisk, oracle, procurer, retriever, rokh, sabre, scimitar, talos, thanatos, tornado, vagabond, zealot 6 CommentsOverview

Another year of growth and transitions into larger projects.

Module, gun, ship construction and trading proceeded as it did the previous year. With reliable income from trading, we expanded our operation into heavy construction by adding a Carrier construction wing to our operation.

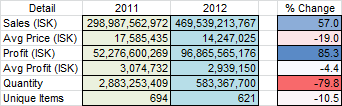

From these numbers we can see that our operation is facing more competition as margins were slightly lower than the previous year. To overcome this, we migrated our inventory to higher per-sale profit items. The drastic change in quantity can be explained by dropping Ammo as a common trade item.

This overview shows the benefits of spreading your trade load between high ticket, low volume items and more volume centered low price items.

Quick Numbers

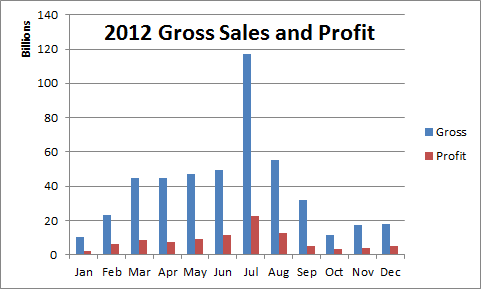

Q1 and Q2 saw renewed vigor into trading as I started to invest more time into logistics and product research.

Q3, July especially, was a record breaking time as I took any liquidity and moved it back into assets. This also marked our shift into high ticket items. Additionally, at this point in the year my trading partner and I had a lot of time to devote to our operation.

September into October is a busy time for me personally. I took a long vacation October and was away from Eve for a few weeks. Everyone needs a break and our performance numbers directly show this.

Highlights

Procurer speculation with the Inferno Patch.

Outsourcing some Highsec logistics with Red Frog Freight during busy periods.

Expanded trading into High Meta items.

Expanded construction and sales into Carrier hulls.

Invested 133 days of training into Racial Cruiser Construction V and Jury Rigging V to enable Tech 3 hull and subsystem production in the coming year.

Invention

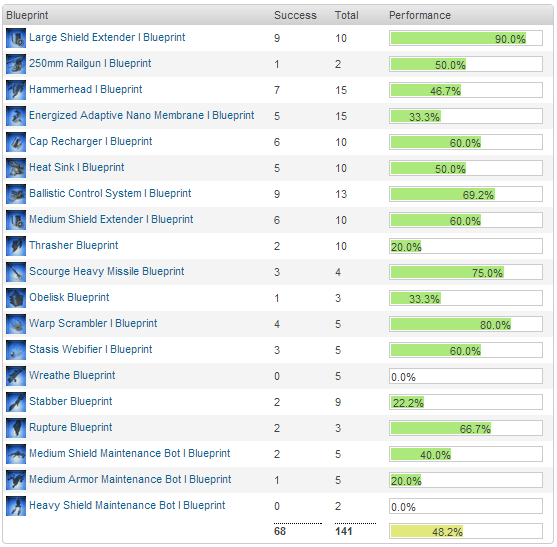

Though there are profits in invention, I found the process of gathering materials, inventing a BPC, putting the component parts together to be uninspired; I had no real focus this year with invention. Most of the time I spent in this area was spent making Drones and increasing my stock of -1/-1 Anshar prints for a rainy day.

My two invention characters have 4-4-4 skills. I have found the training return of getting 5-4-4 or even 5-5-5 skills to marginally increase profits. Since the train time to get a Science skill to 5 is around 20 days, I have not felt the need to sink time into polishing off the skills.

I did keep a database record in order to produced the below summary of my invention statistics The overall success average came out to be 48.2%, which falls in line with any invention guide.

High Meta

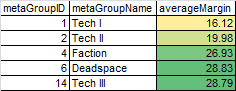

With the addition of Faction, Deadspace, and Officer modules to the market, I saw several trading opportunities throughout the year to work with these items. I had little to no interest in using the tedious contract system to trade these items so when they were added to the general market, I rejoiced.

Here is a summary of the performance of items by Meta levels. Faction and Deadspace items traded well and brought consistent high profits.

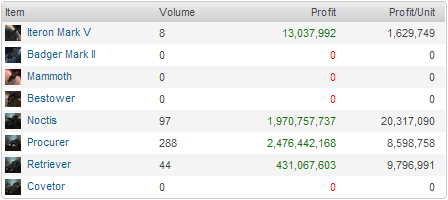

Escalation Barge Teiricide

With the changes to mining barges in the Escalation patch, my partner and I mainly targeted the Procurer hull as its build requirements changed the most with the patch. We speculated that the new barges would cost more post-patch so we build a large stock before patch day.

We ended up selling 288 units for a profit of 2.48 B. We put a smaller amount of effort into Retriever hulls and managed to build and sell 44 for a profit of 431 M.

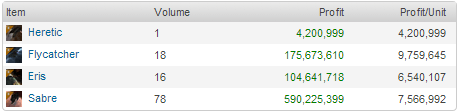

Fear the Sabre

I had limited success with trading other racial Interdictors. The Sabre is the champion of them all and hopefully we see some further balancing to these hulls in upcoming patches.

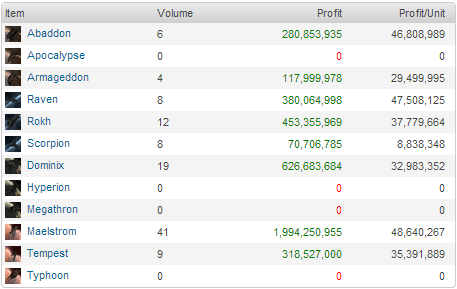

Alpha Maelstrom to Rail Rokh

This year we saw the popularity of the Alpha Maelstrom as a viable Nullsec fleet composition fade away in favor of the Rail Rokh. I was slow to react to this change and by the time I got my Rohk BPO researched to an acceptable level, the switch to the new doctrine was already underway.

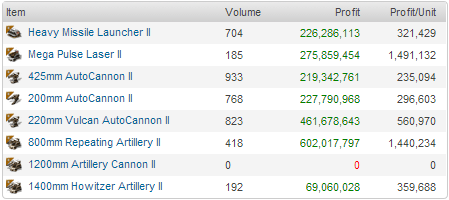

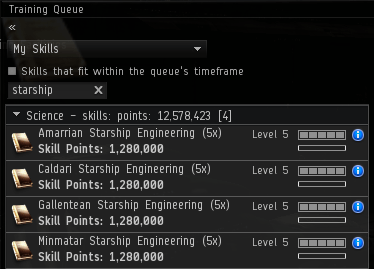

Rigs and Guns

The core rig types (Trimark, CCC, and Field Extender) continued to be a solid performer. If you sell a ship in an area, you should also sell related rigs to popular fits. Let this be a lesson in item cross-selling for anyone building, stocking, and selling ship hulls.

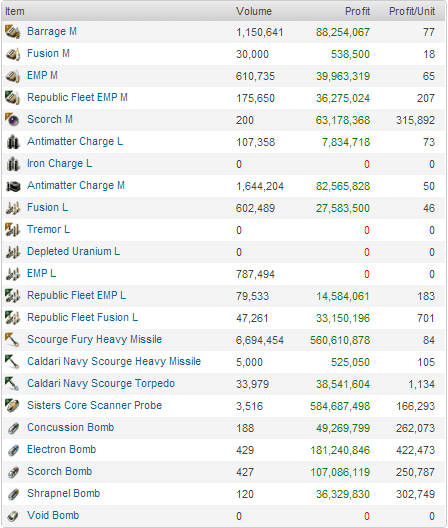

The core gun types seen below also provided some income over the year.

GoonSwarm Shrugged, I Smiled

During the GoonSwarm Ice Interdiction, I speculated on POS fuel and turned a profit. I made 648 M doing some passive trading in Jita on Oxygen Isotopes. In addition, people started to panic and predict that other Isotopes were going to be affected also. I made some early buys on Nitrogen and then sold them off at the height of their price level.

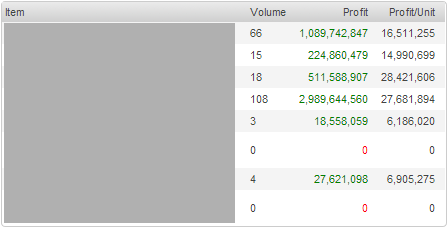

High Meta

I have focused on and found a number of High Meta items that have proven to be very profitable. I’ve blanked out the names of them because I don’t yet want to disclose the item types at this point in time.

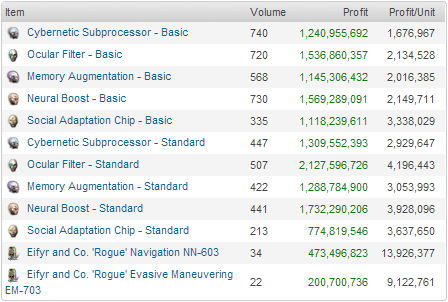

Implants

As expected implants were a high performer.

Standard Modules

High volume modules provide a small source of income as working with these items means you are in a competitive and often saturated market.

The new Drone Damage Amplifier modules sold very well, but I had poor success with the Reactive Armor Hardener.

Batch Ammo

I have continued to have limited success with ammo. I have found the velocity of trading to be very slow which I think is due to the nature of ammo production and consumption.

Since ammo jobs are batch based (meaning that when someone runs a production job they are producing a large bath of ammo rather than a single unit), production has periods of high volume. Additionally when someone buys ammo, that person tends to buy a large stock and slowly work though the pile.

I keep stocking ammo with the intention that it will move, but I always am unimpressed by the numbers.

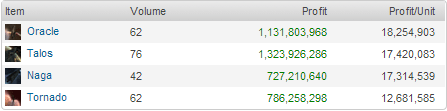

Tier 3 Battlecruisers

The popularity of the Tier 3 BCs remains high as I was able to make a profit on every racial type of them. Surprisingly the Oracle and Talos have been outselling the Tornado.

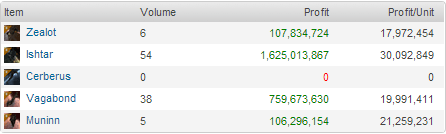

HAC Favoritism

The Cerberus has remained a poor performer with no production or trading opportunities arsing this year. The Ishtar remains a strong seller as a preferred AFK mission ship while the Vagabond holds up the PVP end of the HAC spectrum. I fully agree with Kirith Kodachi’s recent comments on the upcoming rebalance initiative that will eventually hit HACs.

Tech 2 Logistics Falling From Grace

With the recent rebalance of Tech 1 logistics, I expect my production and trade of Tech 2 logistics ships to decline. As Jester pointed out, the proficiency of the Tech 1 variant can cheaply replicate the Tech 2 variant.

Future Ventures

Champion CREST API changes and development with the community to enable 3rd party tools to flourish.

Pressure the CSM for industry and mining changes.

Though the Carrier project is new, it is proving to be profitable so we expect the expand the operation. We are going to look into Dreadnought production in addition to carriers.

Build from stockpile of Tech 3 hulls and subsystem BPCs.

Build backlog of invented Anashar BPCs.

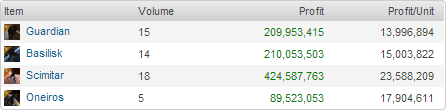

Dreadnought Presents

Posted: 2012-12-20 Filed under: industry, ships | Tags: moros, naglfar, phoenix, revelation Leave a commentAs an early Holiday present to my industry partner Raath, I decided to surprise him and buy two perfect ME Dreadnought BPOs. Each of these Dreadnought BPOs comes with over a year of research and no loss.

I also thought that since we are going to start Dreadnought production, I might as well get a set of guns to go with the additional capital parts needed to build Dreadnought hulls. The additional part and gun BPOs are unresearched, meaning that I will have to get their ME levels up before we start to produce with them. The calculations on the capital guns show a sweet spot of ME 5-7, so I will have to spend under 20 days to get them production ready; the numbers on the new Capital Component prints show that a ME of 4 enables them to be production worthy.

I was not able to find a perfect ME Moros or Phoenix print on the market. I doubt that I will produce the Phoenix class hull as it has poor volume and margins per the research that Eve-Fail has conducted. The Moros as far as I know remains a preferred DPS hull for structure bashing so I will need to locate a nicely researched print soon.

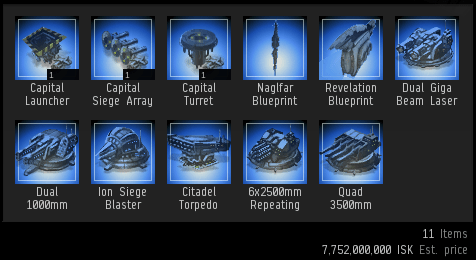

Racial Starship Engineering V

Posted: 2012-12-10 Filed under: eveonline, industry, ships | Tags: legion, loki, proteus, subsystem, tech 3, tengu 6 CommentsAfter 133 days of training, I have completed a training plan on one of my production characters that now allows me to construct every Tech 3 Hull and Subsystem.

Amarrian Starship Engineering V (25 D)

Caldari Starship Engineering V (25 D)

Gallentean Starship Engineering V (25 D)

Minmatar Starship Engineering V (25 D)

Cruiser Construction V (25 D)

Jury Rigging V (8 D)

Up next is Advanced Laboratory Operation V and Advanced Mass Production V to polish off the industry skills.

I’ve run the profit potential numbers on both the Hulls and Subsystems and they are both a good time investment. I just need to either wait for a POS rework or grind standings for a highsec POS.

I have little to no interest in setting up a production POS in lowsec due to the ability of any entity coming along and reinforcing the POS. I would rather operate under the umbrella of a 24 hour wardec timer that would allow me to bring up defenses and recover industry items before the war goes live.

Jump Freighter Invention Decryptor Statistics

Posted: 2012-11-28 Filed under: eveonline, industry, ships | Tags: anshar, ark, nomad, obelisk, rhea 4 CommentsAs my hulking Charon docked in a quiet Amarr outpost, I started to organize the incoming shipment of minerals, PVP goods, and invention items.

I was getting ready to start the invention jobs for two more Anshar BPCs, but then I realized I had forgot something.

Damn, I forgot to buy the decryptors.

The use of decryptors on invention jobs for large-ticket items such as Jump Freighters, Marauders, and Black Ops is almost mandatory if you want to have high profit margins.

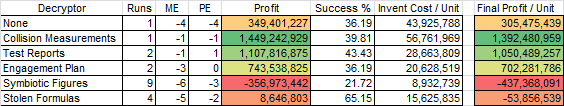

I’ve found that using Collision Measurements is the best type for Jump Freighter invention. Here is the breakdown on how the use of decryptors affects the end profitability of building a Jump Freighter with 4-4-4 skills.

Over the course of the past few months, I’ve built up a small collection of Anshar -1/-1 BPCs for a rainy day. Owning the BPO for the Obelisk, the Capital part components for the freighter, and the Advanced Capital Construction Component Blueprints greatly improves the final profit.

If you want to know more detailed information on the build process, read the Building a Jump Freighter post.

Carrier Runs 1-4

Posted: 2012-11-20 Filed under: eveonline, industry, market, nullsec, ships | Tags: archon, chimera, nidhoggur, thanatos 11 CommentsThe Carrier building venture has turned out to be quite profitable for the first run of 1x each of the racial Carriers.

Purchases

Material Purchases 4,300,785,192.70

Manufacturing Costs 948,074.70

Sales

1,500,000,000.00 Archon

1,500,000,000.00 Thanatos

1,350,000,000.00 Chimera

1,250,000,000.00 Nidhoggur

Totals 5,600,000,000.00

Profit +1,298,266,732.6

Runs 5-8 are currently being built.

Parts for runs 9-12 are nearly ready.

I’m going to have to get another set of racial Carrier BPOs to help feed production lines as we are currently idle while we wait for the Carrier BPOs to come out of manufacturing.