Jump Freighter Industry Collaboration

Posted: 2013-05-30 Filed under: industry, ships | Tags: anshar, obelisk 2 CommentsSuccessful invasion campaigns are run by competent FCs that have logistical backbones with access to intelligence. This dynamic can also be said about large-scale industrial projects; combining the talents from multiple pools can produce very profitable results. Liquid ISK, assets, production management, market intelligence, and a dash of luck are all needed to have great results with industry.

Over time I’ve been running copy jobs on my Obelisk BPO and performing invention jobs on the side. This collection has been growing and has caused an itch that needed to be scratched. I wanted to see these items get produced.

Lockefox @HLIBIndustry and I have been talking about a collaborative project for a few months and we finally got around to narrowing down the scope and details of the collaborative operation.

We combined my assets with Lockefox’s production management and market analysis skills in order to combine our efforts to produce multiple Jump Freighters. Within a few days Lockefox had worked out a four month production timeline stretching from the end of April until August. Not small-scale by any means as we were placing multi-billion amounts of materials into a month long production timeline.

The three Obelisk BPCs were put into invention to net more Anshar runs, but the Invention Fairy said ‘hello no’ with three failures coming in for each invention job. Overall invention success rate for Anshar jobs is coming in at 16.7%.

More updates will come as we run through the production process. Lockefox got the initial project post out yesterday so also watch his blog for updates.

Item Price Stability

Posted: 2013-05-17 Filed under: industry, market, ships | Tags: abaddon, archon, chimera, hulk, ishtar, maelstrom, nidhoggur, orca, PLEX, rokh, tengu, thanatos, veldspar 8 CommentsI leave for two weeks and you all accidentally the market. I was not able the participate in the Odyssey speculation, but I am enjoying catching up on it.

The wild swings that we are seeing in the Moon and Ice markets due to Odyssey adjustments made me reflect on the stability of the items that I trade.

I used my historical database to come up with a report to provide quantitative insight to help give values to the items that I instinctively know are high risk. Here is a snapshot of the lower and upper items listed in my Stability Report that covers three years of trading sorted by standard deviation (σ).

Here are some general observations about the items listed:

- Basic minerals, ammo, and modules are the most stable.

- Capital modules weigh in somewhere in the middle.

- Tech2 ships fill the upper band of the report.

- Tech3 hulls and associated Subsystems are randomly spread over the middle band.

- Certain battleships are high on the report because their popularity has changed over time due to shifting fleet doctrines.

- The Procurer BPO was an item that I speculated on heavily during the last patch, which netted very positive results.

- Capital ships are subject to large swings due to mineral price changes.

A tenant of becoming a good trader is minimizing your risk while trying to maximize your rewards. My advice for new traders is to work with more stable items as shown in the shaded green area of my report; they are subject to less swing and therefore will help minimize risk. As your ISK resources grow, you can move into riskier items that will [hopefully] yield larger returns.

Update

Thanks for all the feedback in the comments. I actually spent some time recently to figure out how to calculate item volatility here https://k162space.com/2013/08/20/hac-price-volatility/. I’m working out how to pull numbers for all my data for a new post soon.

Capital Runs 1-66

Posted: 2013-04-19 Filed under: industry, ships | Tags: archon, chimera, moros, naglfar, nidhoggur, revelation, thanatos 2 CommentsOverview

The Capital construction project has been running for 163.5 days and so far has generated 18.06 B profit with a hull moving every 2.48 days on average.

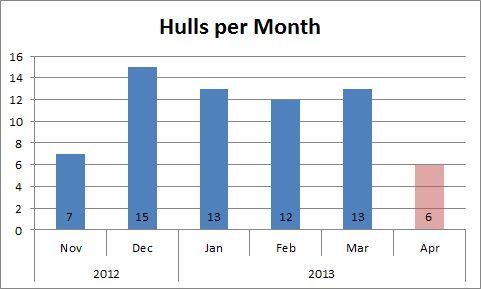

Hull Velocity

April and November are excluded from the average calculation as November was our start-up month and the books for April are still open. The average number of hulls we have been moving has been rather steady, coming in at 13.25/month.

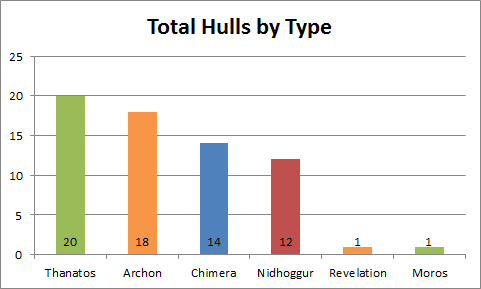

Hull Popularity

As expected the Thanatos and Archon are more popular followed by the Chimera. I wish I could package tears for our brave Nidhoggur pilots, as it is the worst racial Carrier.

We started Dreadnought production in January-February so I’m not surprised that their movement has been low. Given the impending changes to the Naglfar, that BPO has been put into production and will hopefully become a strong source of income #nag2013.

Battle Rorqual

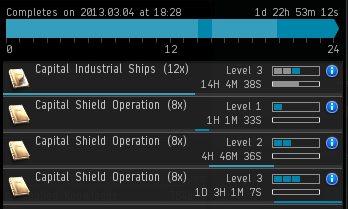

Posted: 2013-03-04 Filed under: ships | Tags: ore, rorqual, thanatos 9 CommentsMy hangar mainly consists of Industrial ships such as Freighters, Jump Freighters, or Orcas. I’ve always been interested in piloting a Rorqual, but not in the classical setting of a ore crunching vehicle.

I invite the PVP community to offer suggestions for a Battle Rorqual as the fits on BattleClinic are rather underwhelming.

So far I spent some ISK and purchased the necessary skills to enable my polished Thanatos pilot sit in a Rorqual. I am going to train up Capital Industrial Ships to IV as the Rorqual receives a modest bonus on drone damage. Since this pilot was trained for an Armor Thanatos, I will also need to get Capital Shield Operation to IV.

Here are the details on the Rorqual bonus with the drone bonus highlighted as it is what enables this hull to excel with drone based combat.

Capital Industrial Ships skill bonuses:

-5% reduction in fuel consumption for industrial cores per level

5% bonus to effectiveness of mining foreman gang links per level when in deployed mode

50% bonus to the range of Capital Shield Transporters per level.

20% bonus to drone damage and hitpoints per level.Role Bonuses:

900% bonus to the range of survey scanners

200% bonus to the range of cargo scanners99% reduction in CPU need for Gang Link modules

99% reduction in CPU need for Clone Vat BayCan use 3 Gang Link modules simultaneously.

Note how the Capital Industrial Ships skill is up from the old NPC price of 450 M. CCP recently changed pricing for NPC skills in a Retribution patch.

![]()

First pass at a fit:

February Financial Report

Posted: 2013-02-28 Filed under: eveonline, industry, ships | Tags: archon, carrier, chimera, dreadnought, moros, naglfar, nidhoggur, revelation, thanatos 2 CommentsOverview

In Winter of 2012, I approached my partner Raath to see if expanding our operation into Heavy Industry was a viable means to take excess liquid capital and start to produce return for our efforts. After scouting markets, running numbers, and placing production characters in proper locations the operation formed.

We’ve reached a state of industrial nirvana as our operational inefficiencies have been reduced and logistic kinks have been worked out over the past few months. Given that we’ve nailed down a solid production cycle, we know what we are going to be spending in minerals every few weeks.

Graphs

A large portion of capital went into the start of our Heavy Industry branch as seen by the grand change in expenses between November and December.

Two periods of expansion can be seen in December and February’s relatively small growth numbers as during these months we poured more capital into Carrier and Dreadnought BPOs, reducing final growth numbers. Also in February a large amount of minerals were purchased for another production cycle that extends into March. Since we operate on a two week cycle, materials purchased at the end of the month show up on the books in the next month.

Historical profits clearly show when the operation started to run.

Dreadnought Blueprints

In January and February we acquired three researched Dreadnought blueprints, two with perfect ME research. Our production lines have expanded to include these ship hulls and in March we should start seeing profits from these jobs.

Industrial Trophy

*rabble rabble rabble*

*throws fuel into the fire*

*rabble rabble rabble*

Have a look at the research I’ve conducted about how just poor of an investment these items can be: Tech 2 BPO Returns and Percentage of Items from Invention vs Tech 2 BPOs.

Having the Tech 2 variant of the BPO means I run a serial production operation (1 BPO) at high margin with a lack of ability to change items in reaction to market changes.

The Tech 1 invention process is a parallel operation (1 or more BPOs) involving lower margins that can over saturate a Tech 2 producer. Inventors do need to maintain of a POS for ME/PE/Copy slots, but the ability to change items in response to market shifts is highly beneficial for Inventors.

Here is a quick rundown of the performance of my Tech 2 BPO vs inventing from one copy of the Tech 1 BPO.

If it was such a poor investment, then why get one? For me the lack of clicks in the invention process and the removal of the wretched POS in the production equation is worth the cost. I have stayed away from large-scale invention specifically due to these two reasons.

Future Plans

No major expansion desires are on the plate at the moment. Right now we are in a ‘slow and steady wins the race’ mode.