Gecko Volatility Post Eve Vegas

Posted: 2015-10-28 Filed under: market | Tags: gecko Leave a commentDuring the Capital Ship session at Eve Vegas we learned that Capital ships will no longer be able to use standard drones. This announcement sent the Gecko market into a period of high volatility given the speculative rarity of the item. Looking at the charts, it seems that the volume and return amounts are trending towards less volatility and a price around 90M.

The blue bars represent numbers that are based on finalized price data while the yellow bars represent an estimated value based on current trends.

If you have a stockpile, I would not sell at the moment. Hold on to that investment.

Tech 2 BPO Prices Post Crius

Posted: 2014-11-14 Filed under: industry, market | Tags: bpo, crius, tech2 2 Commentstl;dr Sale prices for Tech 2 BPOs are down an average of 47% after the Crius release.

Overview

Over the past few years I have been watching prices for publicly traded Tech 2 BPOs and attempting to record the values to the best of my ability.

Some sales completed non-publicly, some were vastly inflated, and some never sold. There is most certainly a lot of inaccuracy in the datapoints given the speculative nature of the Tech 2 BPO market, yet they still serve as guiding value to help us value the BPO.

The Post Crius Marketplace

The volume of posts in the official Sell Orders section of the forums are down, sellers are getting trolled, and people are re-running numbers to reprice the value of the BPOs trying to justify a much lower cost. I’ve seen a lot of CCP Dev intervention to clean up threads and keep people on topic. Overall the market is rather anemic.

Numbers

Trading 205: Regional Arbitrage

Posted: 2014-06-26 Filed under: market 2 CommentsOverview

One of my favorite trading techniques is to buy items in one area and sell them in another area at an increased price. Source your goods in Jita or Amarr and sell them in another area that has a unique trait. What is a unique trait? Well, some examples are systems that are hard to reach, high traffic areas that border lowsec/nullsec, alliance home systems, known centers for PVP activity, or major PVE areas.

Gathering Data

The following will demonstrate how to construct a spreadsheet to gauge market potential.

- Jita = Price in Jita

- Target = Price at target station

- Difference = Jita – Traget

- Margin = ((Target/Jita)-1)*100

- Move =

- Switch to the Price History Tab in the Eve client

- Switch to 3 Months

- Select the Table view

- Select all the data with Ctrl + A

- Paste into your spreadsheet program

- Create a cell that has an Average of the Quantity column

- Use this number for the Move(d) value

- Potential(d) = Difference * Move(d)

- Move(m) = Move(d) * 30

- Potential(m) = Potential(d) * 30

Filtering Items

As you develop your spreadsheet, you can start to notice outliers. Certain items will have nice margins, but will never move. Some items may move, but have a poor return. It is your goal to find the ones that have good movement with a nice return.

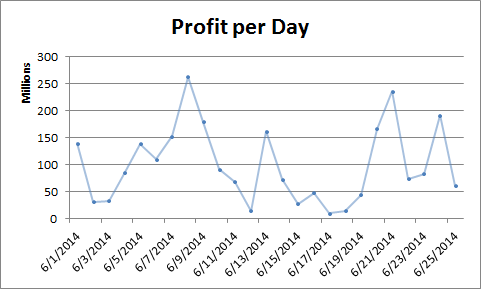

Performance

I wanted to test out my market research so I setup shop in a station and started to import items. In my test region, I’m successfully getting 59% of the total traffic for the region given the items I am targeting bringing in on average 103.8 M profit/day, or around 3.1 B/month.

Capital Runs 1-229 (Final)

Posted: 2014-06-05 Filed under: industry, market | Tags: archon, chimera, cloud ring, delve, khanid, moros, naglfar, nidhoggur, revelation, thanatos, the forge 2 CommentsOverview

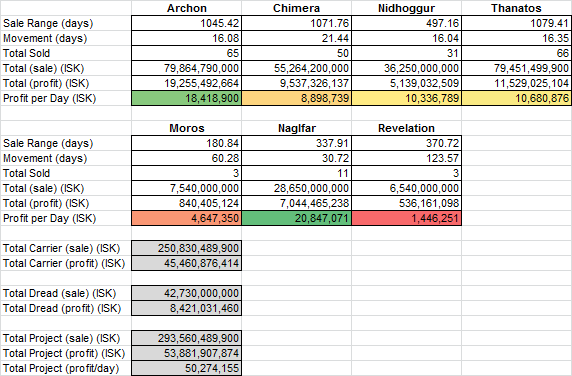

Is is more profitable to build a Carrier from BPCs or BPOs? That question was the initial spark that started my interest in capital production in 2011. Using a BPC copy pack from the market was hardly profitable so I made a plan to own and operate a set of capital BPOs.

Over time as profits started to materialize, more BPOs were purchased to round out production queues. Carrier success then started to bleed into Dreadnought production. With the upcoming industry changes in the Crius expansion, the fate of my capital operation is unknown so I have paused the project.

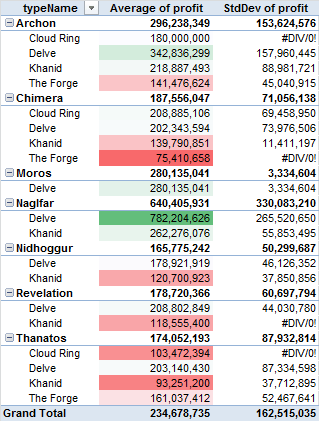

Here are the final numbers for almost 3 years (2.93 to be exact) of capital production. Note that Dreadnought production was a recent addition, only starting in mid-2013. Special tribute goes to my industry partner, Raath, as he was the lead on this massive project.

tl;dr Build Naglfars and Archons.

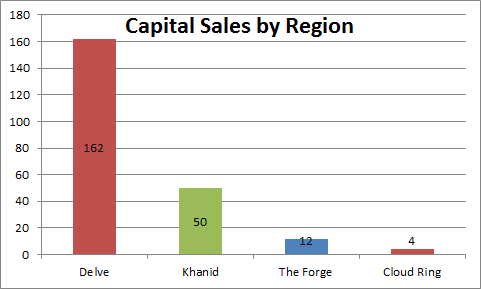

Sales

Performance

Naglfar sales in Delve outperformed all other types and regions yet showed the most standard deviation.

The Naglfar outperformed every other hull type when it came to profitability per time period. This is due to the balance update it received in the Odyssey update where it became a viable doctrine ship. The Archon, due to the popularity of the Slowcat doctrine, was also solid performer.

Capital Production Paused

Posted: 2014-06-04 Filed under: industry, market, nullsec, ships | Tags: archon, chimera, moros, naglfar, nidhoggur, revelation, thanatos 1 CommentAfter waiting for a few research jobs to finish up, I tore down the Highsec research POS and consolidated all the materials used for capital production. I am not sure about the viability of Lowsec capital production with the upcoming changes in the Crius expansion slated for July 22nd.

Presently I have more questions than answers.

- How is the mandated refine differential between High-Low-Null going to affect build prices?

- Will Low-Null mining become a profession that can compete with ore import costs from Highsec?

- How will the general population buy capitals if the majority of them start to be delivered in sovereign Nullsec space?

- Are the logistics of moving compressed ore from Highsec into Low-Null going to be worth the ::effort::?

- Will capital prices eventually trend upward due to the lack of construction in Lowsec and cause Lowsec operations to become competitive with Nullsec?

- Will Nullsec entities provide protection for large-scale mining operations in their space?

- Will a competitive NPC Nullsec-Lowsec market spring up around major construction hubs?

I haven’t had the time or inclination to research these topics in depth; I hope to become motivated when the Crius changes start to hit the test server.