Item Price Stability

Posted: 2013-05-17 Filed under: industry, market, ships | Tags: abaddon, archon, chimera, hulk, ishtar, maelstrom, nidhoggur, orca, PLEX, rokh, tengu, thanatos, veldspar 8 CommentsI leave for two weeks and you all accidentally the market. I was not able the participate in the Odyssey speculation, but I am enjoying catching up on it.

The wild swings that we are seeing in the Moon and Ice markets due to Odyssey adjustments made me reflect on the stability of the items that I trade.

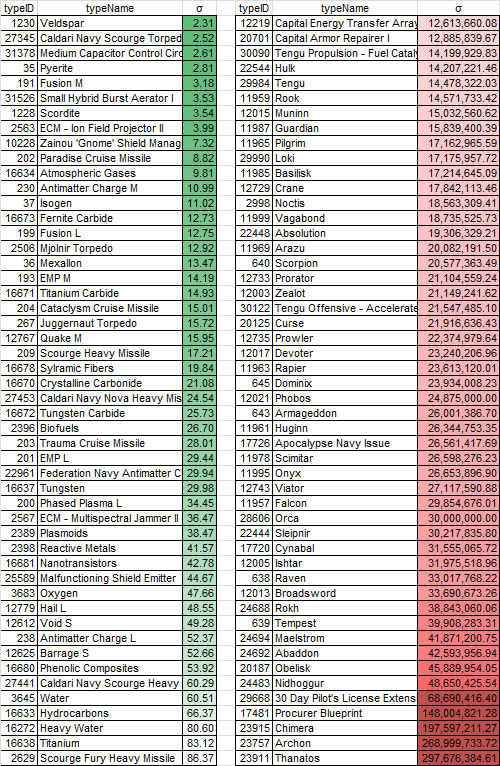

I used my historical database to come up with a report to provide quantitative insight to help give values to the items that I instinctively know are high risk. Here is a snapshot of the lower and upper items listed in my Stability Report that covers three years of trading sorted by standard deviation (σ).

Here are some general observations about the items listed:

- Basic minerals, ammo, and modules are the most stable.

- Capital modules weigh in somewhere in the middle.

- Tech2 ships fill the upper band of the report.

- Tech3 hulls and associated Subsystems are randomly spread over the middle band.

- Certain battleships are high on the report because their popularity has changed over time due to shifting fleet doctrines.

- The Procurer BPO was an item that I speculated on heavily during the last patch, which netted very positive results.

- Capital ships are subject to large swings due to mineral price changes.

A tenant of becoming a good trader is minimizing your risk while trying to maximize your rewards. My advice for new traders is to work with more stable items as shown in the shaded green area of my report; they are subject to less swing and therefore will help minimize risk. As your ISK resources grow, you can move into riskier items that will [hopefully] yield larger returns.

Update

Thanks for all the feedback in the comments. I actually spent some time recently to figure out how to calculate item volatility here https://k162space.com/2013/08/20/hac-price-volatility/. I’m working out how to pull numbers for all my data for a new post soon.

Did you saw BS mineral changes ?

😀

Yes I saw them but I was too slow to react. Oh well.

Don’t you want to normalize that so that it isn’t just largely an expression of the raw cost of the item? I know my Stats and Econometrics professors would hate to hear it, but I forget the proper term for this.

I second this…

for instance, the standard deviation normalized with average price (out of my head) for pyerite is ~20%, and only ~8% for the tengu, yet the coloring of the chart places the tengu much worse.

Ah, here’s what I was looking for Coefficient of Variation (http://en.wikipedia.org/wiki/Coefficient_of_variation). I couldn’t remember if it was more complex than this, but it’s just dividing by the mean.

Now, if you want to know how much of your ISK is at risk per transation due to variation the you wouldn’t want to use this, and that could be completely legit. But I’d think you’re more looking at something like “if I was going to sink 1B into a market, which would be riskiest” then you’d want it normalized.

You have to normalize each standard deviation to the mean of the respective distribution to make them comparable. Sort the items by relative standard deviation sigma/mean

You need to normalize each standard deviation by the mean of the respective price distribution to make them comparable.

I don’t understand all the maths talk but it seems wierd to me seeing Veldspar at the top as green. Surely Trit is one of the most likely to fluctuate as we really have no idea how things will pan out. Changes to the ice in high sec (which will cause miners to mine trit during ice down times) and changes to null sec (more local trit from ABC, Spod etc) offset by a shift to ice by many nullsec miners which is mandated by the new game design.

All we know is that Trit will become significantly cheaper, suggesting that Veldspar, which is at the top of your list, is actually one of the worst possible pre-patch investments.